How crowdfunding can help save Silicon Valley from its harebrained investors

There are fears that another Ice Age is about to hit Silicon Valley because of the implosion of its unicorns — start-ups valued at more than one billion dollars. By one estimate there were 229 such companies in January of this year. Their valuations are dropping precipitously because they were overpriced and overhyped. The fear is that venture capital will dry up and hurt the innovation ecosystem.

In previous eras, such a setback to venture capitalists would surely have had a chilling effect on the innovation ecosystem because startups were dependent on their funding. But in today’s era of exponential technologies, there will hardly be a blip.

To start with, the cost of building new technologies has dropped so significantly that inventors no longer need venture capital. The desktop computers, server farms, racks of hard disks, and enterprise software that were needed would cost hundreds of thousands, sometimes millions, of dollars. Today, there is on-demand computing and cloud storage — which can be purchased for almost nothing from companies such as Amazon, Google, and Microsoft. And tools such as sensors and 3D printers, which are needed for building sophisticated medical devices and robots, are inexpensive. What costs the most in Silicon Valley is rent and food. But you can share an apartment and live on pizza and ramen noodles.

And instead of begging venture capitalists, angel investors, or friends for the $50,000-100,000 that it typically costs to start a technology company, founders can go directly to the people they are building their products for. They can post a video of a heart-felt pitch and demonstrate a prototype of their ideas on sites such as Indiegogo, Kickstarter and Plum Alley. If they get funded they’ll know they have a good idea; otherwise is time to go back to the drawing board and come up with something better.

The crowd makes better decisions than venture capitalists do. With crowdfunding, there is direct feedback from the market and a strong connection between the inventor and the funder. The community of funders feels a sense of ownership for the product and helps spread the word. And there is no filter such as a venture capitalist who has his own race and gender biases and only invests in the same trendy technologies as other VC firms.

The failure rate of crowdfunded projects is remarkably low. Three quarters of venture capital investments fail to return investor capital. Yet only 9 percent of crowdfunded projects fail to deliver on what they promised, according to Ethan Mollick of University of Pennsylvania –who researched 47,188 Kickstarter projects.

When entrepreneurs take money from venture capitalists, they know that this is coming from deep pockets and is just a financial investment. When dealing directly with customers it is personal; so entrepreneurs put in extraordinary effort and spend their own money to fulfill their promises. This is what leads to better outcomes.

One of the best examples of a technology that would not have seen the light of day without crowdfunding is virtual reality. As Mollick explained, this was largely ignored by traditional funders after it failed to gain traction in the 1990s. In 2012, a 19-year old Palmer Luckey, who had built a prototype of a virtual reality headset in his parent’s garage, launched a Kickstarter campaign for a commercial product. His goal was to raise $250,000 but there was so much demand that he ended up getting $2.4 million in orders. The product he later developed, Oculus Rift, was acquired by Facebook in 2014 for $2 billion. This set off a frenzy of funding by venture capitalists and greatly accelerated the progress of a world-changing technology.

So far, there have been limits to what start-ups could offer the crowd. They could only pre-sell their product and offer perks such as T-shirts and badges. This is about to change.

Starting May 16, the Securities and Exchange Commission is rolling out a new program that will allow private companies to use crowdfunding to sell securities — up to $1 million over a 12-month period. This was a provision of the 2012 Jumpstart Our Business Startups Act (or JOBS Act) to assist small companies with capital formation.

Individual investors with less than $100,000 of net worth will be allowed to invest the lesser of $2,000 or five percent of their annual income or net worth. Wealthier individuals can invest up to 10 percent. The investment must, however, be through an authorized funding portal. These portals are required to vet the companies and let investors shop among offerings and discuss them online. They can’t offer investment advice, make recommendations, or solicit purchases.

One of the first funding portals, Crowdfunder didn’t waste time in taking advantage of the new rules. It recently announced a VC Index Fund which offers an investment in a portfolio of hundreds of venture-capital backed startups. Crowdfunder chief executive Chance Barrett said his goal was to “allow everyday people to invest online alongside the world’s leading venture capitalists, while targeting a fund 10x more diverse, in the number of investments, than a traditional VC.” In other words, the public can become “super VCs.”

It remains to be seen if equity crowdfunding achieves the same success as product crowdfunding. The stakes are now higher and the risks of fraud are much greater. But one thing is certain: the balance of power is rapidly shifting — from venture capitalists to entrepreneurs. This is a good thing because it will lead to a greater diversity of start-ups. And with a bit of luck, there will also be fewer over-priced unicorns and less wastage of investment capital — because the venture capitalists will follow the crowd.

For Vivek Wadhwa's site, please click here.

To follow Vivek Wadhwa on Twitter, please click here.

TO FOLLOW WHAT'S NEW ON FACTS & ARTS, PLEASE CLICK HERE!

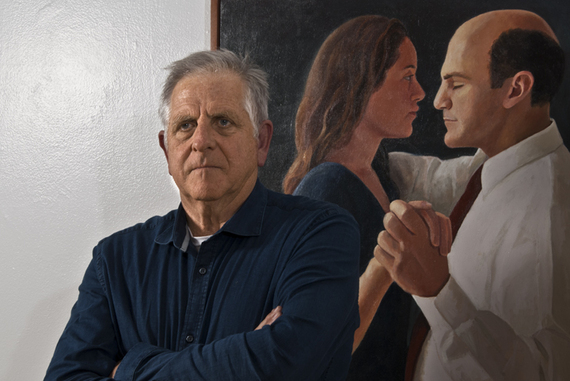

Vivek Wadhwa is a Fellow at Arthur & Toni Rembe Rock Center for Corporate Governance, Stanford University; Director of Research at the Center for Entrepreneurship and Research Commercialization at the Pratt School of Engineering, Duke University; and Distinguished Fellow at Singularity University. He is author of “The Immigrant Exodus: Why America Is Losing the Global Race to Capture Entrepreneurial Talent”—which was named by The Economist as a Book of the Year of 2012, and ” Innovating Women: The Changing Face of Technology”—which documents the struggles and triumphs of women. In 2012, the U.S. Government awarded Wadhwa distinguished recognition as an “Outstanding American by Choice”— for his “commitment to this country and to the common civic values that unite us as Americans”. He was also named by Foreign Policy Magazine as Top 100 Global Thinker in 2012. In 2013, TIME Magazine listed him as one of The 40 Most Influential Minds in Tech.

Wadhwa oversees research at Singularity University, which educates a select group of leaders about the exponentially advancing technologies that are soon going to change our world. These advances—in fields such as robotics, A.I., computing, synthetic biology, 3D printing, medicine, and nanomaterials—are making it possible for small teams to do what was once possible only for governments and large corporations to do: solve the grand challenges in education, water, food, shelter, health, and security.

In his roles at Stanford and Duke, Wadhwa lectures in class on subjects such as entrepreneurship and public policy, helps prepare students for the real world, and leads groundbreaking research projects. He is an advisor to several governments; mentors entrepreneurs; and is a regular columnist for The Washington Post, Wall Street Journal Accelerators, LinkedIn Influencers blog, Forbes, and the American Society of Engineering Education’s Prism magazine. Prior to joining academia in 2005, Wadhwa founded two software companies.