What are the odds of Trump surviving 2018 in office? An expert crunches the numbers

Donald Trump has been under constant fire from critics since he began his campaign in the summer of 2015, and his presidency has so far been perhaps the most chaotic and bizarre in recent decades. But as he approaches the first anniversary of his inauguration, the pressure is only getting more intense.

First came the revelations in the bestseller Fire and Fury, which reports on various White House aides concerns about the presidents mental capacity. Then came Special Counsel Robert Muellers request to question Trump about the Trump campaigns dealings with Russia, and his decision to subpoena the presidents ostracised former ally, Steve Bannon.

So as Trump prepares to celebrate a year since his inauguration, what are the chances hell still be president when 2018 is over?

There are plenty of guesses and estimates out there, informed and otherwise. Bannon for one is quoted in Fire and Fury as saying Trump only has a 33.3% chance of making it to the end of his term in January 2021. But while many experts and insiders have opinions on the matter, when it comes to forecasting future events, betting and prediction markets have been shown to be rather more reliable.

A prediction market is a simple financial market that allows everyone to bet on an uncertain future outcome. The market most interesting for us asks: Will Donald Trump be president at year-end 2018? The yes-asset will pay 100 cents if Trump is still in office at midnight December 31, 2018, and 0 cents if he is not. Because an asset is worth at most 100 cents and at least 0 cents, the asset price is between 0 and 100 just like a probability.

Since anyone can trade in these markets and adjust the prices, prediction markets have been characterised as a market-based form of the wisdom of the crowd. If the crowd thinks the asset is underpriced that is, that the implied probability is too low then people can buy the asset at an expected profit and thereby adjust the price upwards. If the asset is seen as overpriced, then traders can sell to bring the price down.

And indeed, research shows that the prices in these markets are a good predictor of the probabilities. Whenever the asset price is 60 cents, then in 60% of the cases the underlying outcome does in fact happen. If the price is 70 cents, then the underlying outcome happens in 70% of the cases, and so on. That means prices are well calibrated; on average, they correspond to probabilities.

Another study finds that assets set to expire more than half a year in the future can exhibit slight biases. Prices above 50 cents tend to be slightly larger than the true probabilities so looking at the odds on Trumps future, its important to regard the prices as optimistic estimates.

What the crowd says

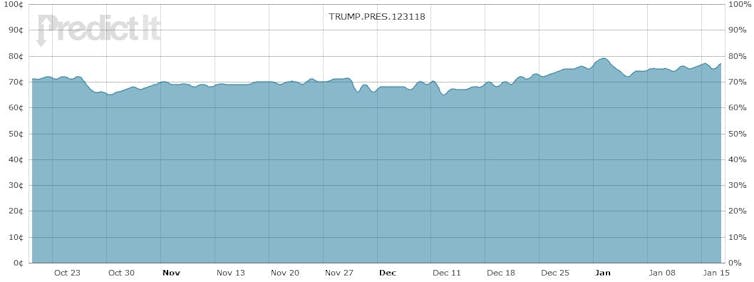

Currently, the yes-asset trades at 77 cents, implying a 77% or less probability that Trump survives 2018 in office. So the market thinks that while the threats to his presidency are many the Mueller investigation, rumours of early stage dementia, former staffers with axes to grind Trump is considerably more likely to survive than be ousted.

Chances of Trump staying in office in 2018 (90 day price chart). https://www.predictit.org

Chances of Trump staying in office in 2018 (90 day price chart). https://www.predictit.org

Still, of the 57 US presidential terms served prior to Trump, only nine ended prematurely, meaning 84% of terms were fulfilled. The market expectation of Trump making it through the next year (not even the entire term) is therefore significantly below this historical average.

Another market asks: Will Trump be president at year-end 2019? Certainly the probability must be lower here, since Trump cannot resume office in 2019 if ousted in 2018. And indeed, the yes-asset in this market is currently trading at 62 cents, indicating only a 62% probability or less that Trump survives the next two years in office.

But despite the shockwaves generated by Fire and Fury, the prices in both markets have not changed much in the ensuing weeks. Indeed, if anything, they went slightly up around the books release, only to revert again a few days later. It seems the markets may have considered the books revelations just another episode of Trump melodrama.

However, while the odds didnt change much, the trading volume (i.e. the number of assets bought and sold) started to explode on January 1, around the time newspapers first started discussing the book. These numbers indicate that, while the book did create a lot of interest, it did not considerably affect peoples estimation of Trumps chances of staying in office.

The last time we saw such large trading numbers on these markets was on December 1, 2017 the day Michael Flynn (Trumps former National Security Advisor) pleaded guilty to lying to the FBI in its Russia investigation. With new twists in the administrations various scandals coming thick and fast, it seems safe to say there are other spikes to come but whether they will shift the odds is another matter.

Christoph Siemroth, Lecturer in Economics, University of Essex

This article was originally published on The Conversation. Read the original article.