Coronavirus and the global economy: yes, there really is cause for optimism

Stock markets are rebounding on the back of the newly agreed US$2 trillion American fiscal stimulus plan. It comes after a week that was the worst in history for the Dow and many others around the world. My impression is that the unfolding global recession has now been fully priced into stocks by investors.

That recession looks all but guaranteed, of course: Chinese GDP is estimated to have dropped 12% in the first two months of the year – a harbinger of what is coming everywhere. One useful guide is the market for corporate default swaps, which are financial instruments that investors use to hedge against companies running into trouble. The Markit iTraxx Europe Crossover index, which tracks European corporate swaps, is implying a 38% probability in European companies defaulting on their debts in months to come.

Yet let’s put things in perspective. The coronavirus is certainly causing a tragic loss of human lives, but the mortality rate appears to be lower than some early predictions indicated.

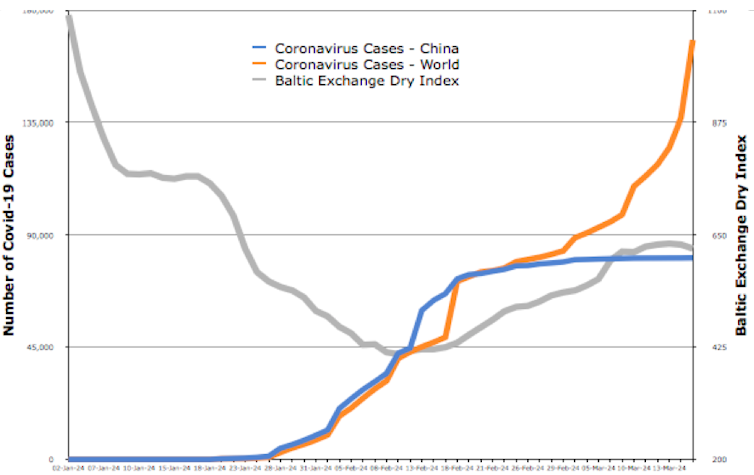

So what will be the economic impact of the lockdown measures required to keep the mortality rate down? A large part of the fallout to date – particularly on stock markets – has actually been from negative sentiment rather than real effects. The Baltic Exchange Dry Index, which measures the average price of moving raw materials by sea, is the best indicator of global trade in real time. It bottomed out in February and has since improved as the China crisis has receded – per the chart below.

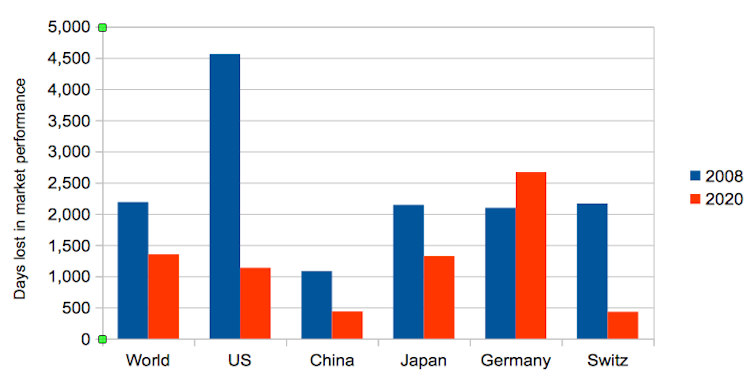

It’s also interesting to compare the 2008 and 2020 market crashes. I have calculated the number of days to the lowest market level in 2008 and 2020, relative to the last previous day when stock markets were at the same level. For example the US stock market bottom of March 9 2009 was the lowest point since September 12 1996 – 13 years or 4,561 days earlier. The low this time, assuming it is not exceeded, was last seen on July 7 2016 – less than four years ago. The chart below confirms that this pattern has been seen in most markets around the world.

Assessing 2020

My late colleague Professor Stewart Hamilton was IMD’s specialist in financial crises. He used to quote the famous economist John Kenneth Galbraith, who said: “There can be few fields of human endeavour in which history counts for so little as in the world of finance.”

This certainly applies to 2020. Whereas 2008 was about a collapse in demand, the coronavirus is causing collapses in both supply and demand. It is not a banking crisis, at least not for the time being, so many corporations will hopefully be able to rely on bank credit, over and above government rescue packages. The economic impact is also apparently different across countries.

Interestingly, the stock market impact has been more severe on value stocks, meaning mature companies that attract investors by paying dividends, not because they are seen as having great potential for growth. Compared to the so-called growth stocks, such companies typically have lower ratios between their stock market prices and earnings (PE ratio).

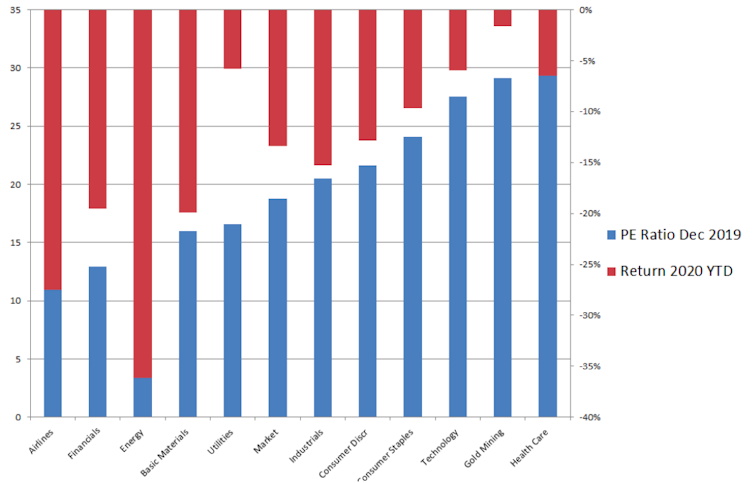

The chart below shows different sectors along the x axis and shows their average PE ratios in the blue bars. The sectors towards the left, like airlines and finance, are value stocks. Those on the right, such as technology and healthcare, are growth stocks. The red bars show what has happened to their average share prices – in other words, how far they have fallen.

What it shows is that the growth sectors’ shares have declined the least. This is strange because in a financial crisis, investors tend to rely on stocks that provide value today. As finance economists say, “in winter we burn fat”. To me, this indicates light at the end of the tunnel; that companies who you would expect to generate growth, will still generate growth.

Seven recommendations

I know I am playing the optimist here, and the coming days may take me back to a different reality. But let us at least assume that we have seen the worst and it is now time to think about the after-crisis. What can be done?

-

Governments and central banks have been quicker to respond than in 2008, but some sectors need more support than others. States need to encourage banks to lend and be flexible, taking advantage of ultra-low interest rates.

-

Many are calling the crisis a black swan event, meaning a cataclysm that has caused great economic hardship and could not have been foreseen. But such a pandemic was expected in 2017. Policymakers can therefore use the data from this crisis to plan for future crises. Companies should learn from what has worked best and permanently make it part of their values: making employee safety their top priority, for example.

-

The world will become less globalised now. Companies must adapt their supply chains and markets to protect themselves in the event of a repeat. That means refocusing on their home markets as much as possible now, and striking a new, safer balance between local and global after the crisis is over.

-

The 2008 crisis had a massive impact on corporate investment from which we have not yet recovered, since the banking crisis meant that banks were unable to lend. Since 2020 is not about a banking crisis, companies will emerge strongest if they avoid under-investing.

-

Government policies will determine how well companies can come through. So more than ever, the private sector must cooperate. It is not the time to complain about government, but to collaborate.

-

Planning for different possible outcomes from this crisis is useless. It was the same in 2008. It is better to be resilient and reactive, and to focus on what is happening now.

-

Finally, the best acquisitions are made in bad times. So for those companies that have the means, it is a good time to think about mergers and acquisitions because deals will be cheap.

Arturo Bris, Professor of Finance, International Institute for Management Development (IMD)

This article is republished from The Conversation under a Creative Commons license. Read the original article.